An indicator used to measure the corporate value and earnings performance of life insurance companies

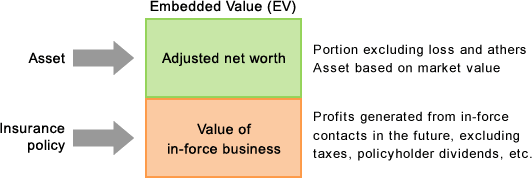

The portion of the assets and in-force contracts held by the insurance company ultimately attributable to shareholders as of the time of calculation is evaluated. EV is the total of adjusted net worth and the value of in-force business.

Adjusted net worth is based on balance sheet (J-GAAP) values and calculated as the sum of the total net assets, appropriate adjustments for unrealized gains/losses and other items.

Value of in-force business is the present value at the valuation date of future after-tax profits distributable to shareholders from in-force business as of the valuation date, calculated under a set of assumptions.

In general, life insurance policies provide a steady level of premium income over a long period of time, while acquisition costs are expensed intensively in a short period around the time of policy sales. This timing difference in recognizing revenues and expenses and the long time it takes before profits are recognized after a policy is sold are the characteristics of life insurance accounting. As these characteristics make it difficult to evaluate a life insurance business based on single-year financial results, disclosing EV is seen as a useful way of giving investors a more accurate picture of operating conditions.

First, we changed the most important management indicator for corporate value from European Embedded Value to Comprehensive Equity (“CE”) based on International Financial Reporting Standards (IFRS).