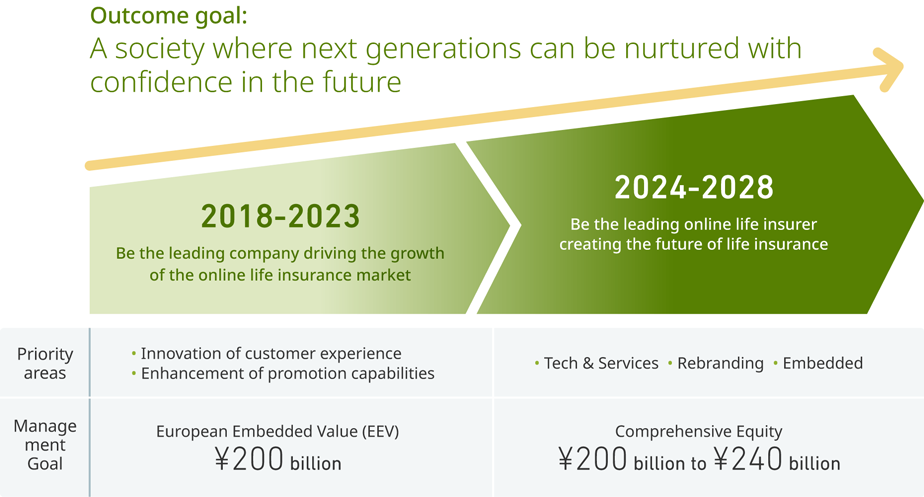

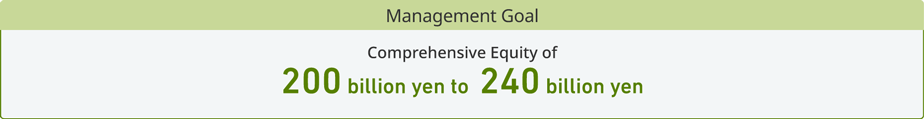

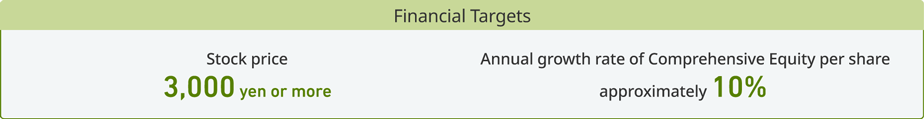

We have formulated a new five-year mid-term business plan to FY2028. Following the adoption of International Financial Reporting Standards (IFRS) in FY2023, we have set “comprehensive equity” linked to our IFRS financial statements as the principal management indicator of our corporate value. The new plan sets a target for comprehensive equity of ¥200 billion to ¥240 billion by FY2028.

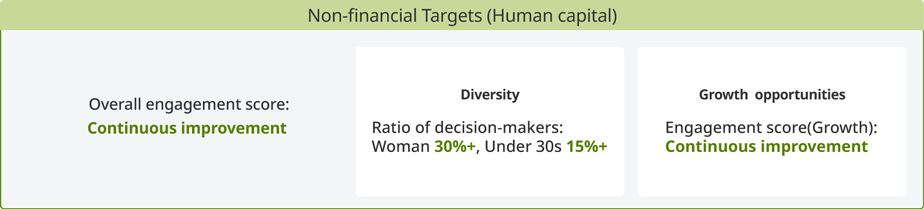

- Decision-makers are directors and employees at the department head level and above.

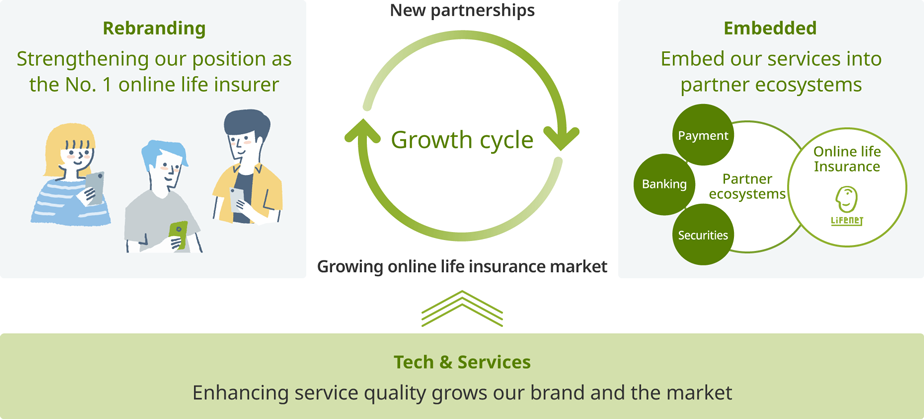

To achieve our growth target for FY2028, the new mid-term plan sets the three priority areas of Tech & Services, Rebranding, and Embedded for growth and human resources strategy that will be key for the Company’s next stage of growth.

Connections between our businesses and the priority areas

Our customers, particularly younger-aged customers, have responded favorably to our direct businesses, supporting steady growth. The market niche we established with the direct business has opened a new business channel of using partner businesses, which we initiated in 2016 with KDDI Corporation and have continued to broaden across other industries. The new channel is triggering a virtuous cycle in which working with more partners increases the market for online life insurance, giving us more room to grow our overall business. We plan to accelerate our business growth by further anchoring our position as the No. 1 online life insurance company in Japan and embedding our services in the ecosystems of our partners.

Growth cycle of the online life insurance market

The previous Management Policy launched in 2018 prioritized investing in “innovation in the customer experience” and to “strengthen our sales capabilities” to drive the growth of the online life insurance market. In the direct individual insurance business, we focused on improving our website’s user interface and experience and conducted an aggressive marketing campaign that produced a significant increase in policies in force. We also stepped up efforts to form partner alliances across different industries with the intention of forming a base for a virtuous cycle that will generate continuing growth in the online insurance market. In addition, we activated Group synergies with partner company KDDI Corporation to launch group credit life insurance operations.

In FY2024, we launched a new Mid-term Plan, set a new outcome goal, and updated our Management Policy to reflect our business performance and the current business environment and to renew our efforts to address material social issues so we can continue generating strong business growth in the future.