This page describes the main trends surrounding the Company (the Group) as it seeks to fulfill the targets in its Mid-term Plan.

Financial businesses, including securities, banking, and housing loans, that are adjacent to the insurance industry are introducing online services, which are permanently changing the structure of their industries. Customer behavior patterns are evolving as many of their customers are already using online financial services on a daily basis through their smartphones and other devices.

Increasing financial services available online

Online securities*1

75.3%

Online banking*2

61.6%

Online housing loans*3

45.6%

- Percentage of accounts with online transactions balances to the total number of customer accounts at securities firms nationwide

- Percentage of banking transactions conducted online

- Percentage of private loan users who use either or both of “housing loans provided by online banks” or “online-only housing loans provided by general banks” (FY2019).

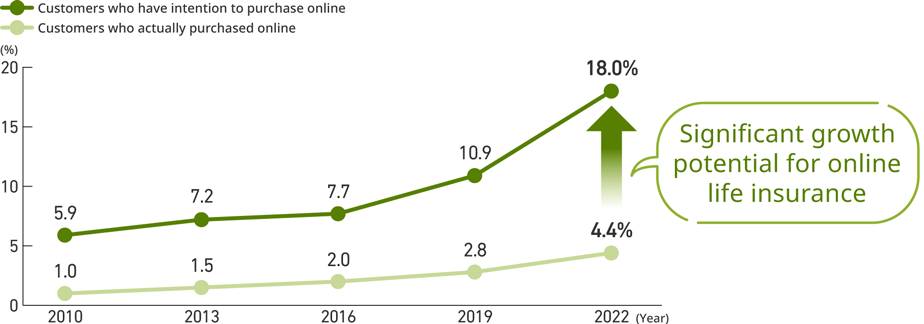

The insurance industry is undergoing a similar structural change as online services become more prevalent, and we believe this development presents increased potential for life insurance market growth. The National Field Survey on Life Insurance recorded a growing percentage of responses of “I would like to purchase life insurance online in the future.” We believe this indicates considerable growth opportunity for the Company’s (Lifenet Group’s) online life insurance business.

At the same time, the number of companies offering online insurance products and services is also increasing. We recognize that for us to maintain our dominant market position for online life insurance, we need to continue refining the value we provide and creating new value offerings.

Intention to purchase life insurance online

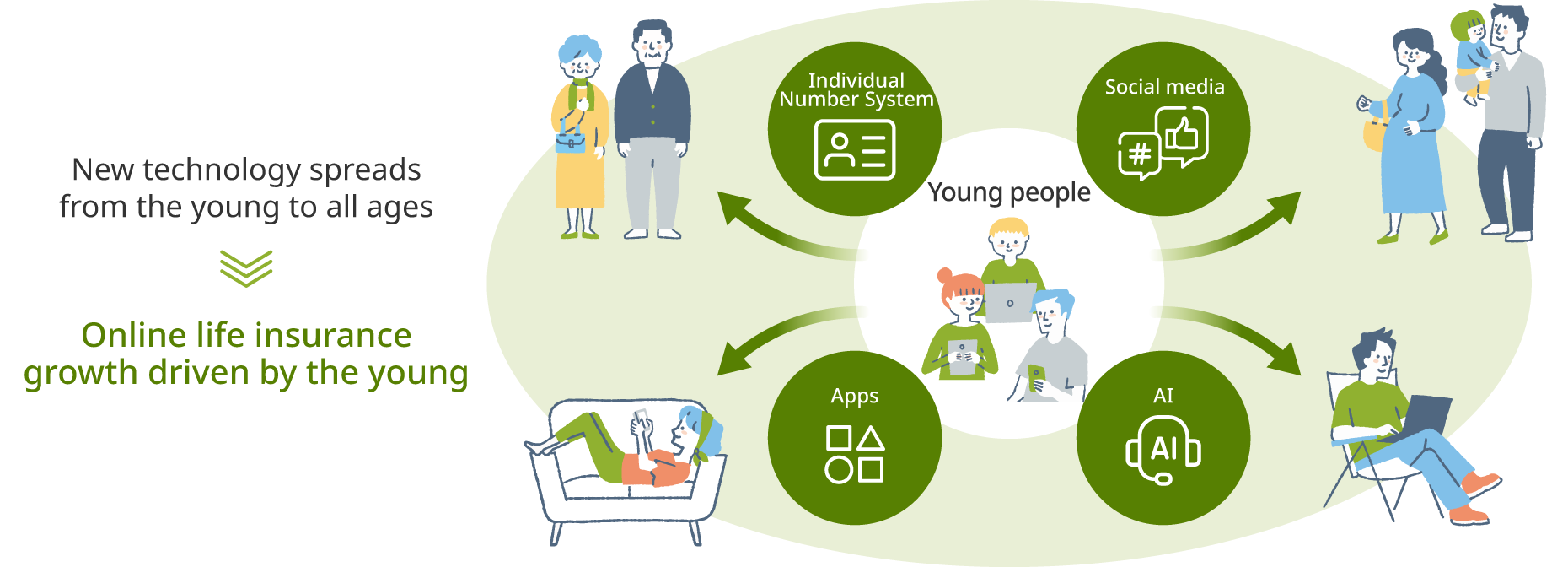

As the market for online life insurance grows, we believe that the expanding the Company’s (Lifenet Group’s) business scale will require adapting to the changing lifestyles and needs of our customers so our products and services will continue to be the preferred choice of the young people of each generation.

The reason for our focus on young people is because we believe the younger generations are the early adopters of new technologies and they are a key to introducing and spreading the technologies to people in other age groups. We believe that providing highly convenient services accessible with smartphones and other devices increases use by younger customers, which creates vector points for introducing online life insurance products to other groups.

- Individual Number System is a system in which all people living in Japan are given an individual identification number for the purpose of improving convenience and others for citizens. It is also available online and you can apply to services online related to parenting by the one-stop service and can receive notifications from administrative organizations.

Young people tend to have relatively lower incomes, but at the same time they also have many important life events ahead of them, which means that they may be the generation with the greatest need for life insurance. The concept of life insurance arose from people’s desire to ensure security for the future. We at Lifenet Insurance want life insurance to be viewed as a key element to helping each person prepare for the future. We hope that the young people who are hesitant to start a family due to financial worries or shy away from taking on challenges because they are uncertain about the future will see how our product can provide the certainty they need continue pursuing their dreams.

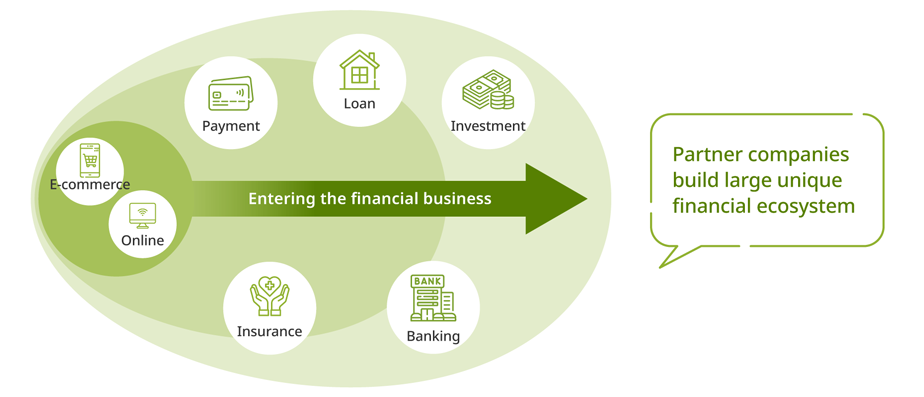

A growing number of non-financial companies, such as telecom firms and e-commerce retailers, having been expanding into online financial services, and some have established vast presences in the market. We expect the incorporation of insurance business into financial ecosystems centered on transaction services and point programs to stimulate even further growth for the online insurance market.

We believe it is essential for our Group to continue focusing on developing and offering attractive products and services, and on strengthening the Group brand to ensure we remain the company of choice for business partners.