We launched our online business selling insurance directly to individual customers in 2008. We built on the strength we gained in the direct business to begin working with partner companies in 2016 and expanded further to encompass group credit life insurance business in 2023.

- Tech&Services

- Rebranding

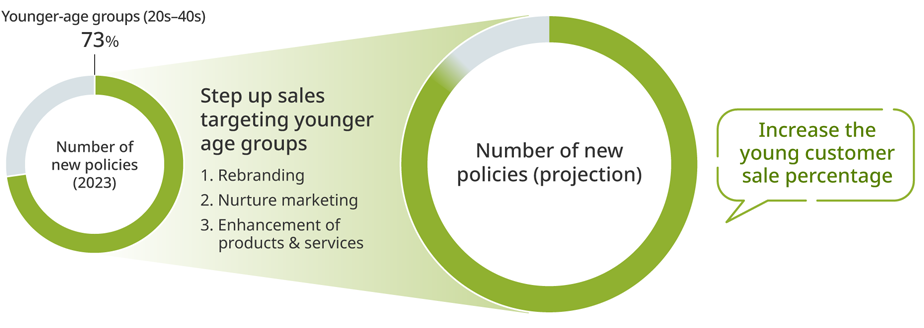

The direct business has achieved steady growth through its appeal to individuals seeking to select their insurance options online. We have grown into the leading online life insurer by offering a wide range of highly evaluated products and services. In recent years, we have also expanded our customer base of middle-aged individuals.

We believe a new growth model is needed for the direct business to achieve further growth in the increasingly competitive market. We are making rebranding a priority and refining the value we provide to stand apart from competitors.

We are also improving our customer experience by integrating AI, the My Number system, and other technologies and programs to make Lifenet the brand of choice for younger customers and to develop services unique to the leading online life insurer.

Direct business growth concept

- Image is for illustrative purposes only

- Tech & Services

- Embedded

Since partnering with KDDI Corporation in 2016, we have continued expanding our collaborative operations into various industries. Participating in the financial ecosystems of partners with broad customer bases and strong brands gives our products and services exposure to a greater range of customers.

We are responding to the growing trend of companies establishing finance ecosystems with transaction services and point programs by deepening ties with existing partners and developing new partners.. We believe creating stronger ties with our partners will be key, and we will work to embed deeper into our partners’ priority strategies and financial ecosystems. We will also incorporate services developed by our partners to enhance the quality of our services and deliver seamless insurance and service operations.

We will also seek to develop new partnerships with the aim of forming alliances with companies that have a broad customer base, attractive brands, and extensive data.

Deepening ties with existing partners and developing new partners are the core strategies for elevating our partnership business into a major driver of long-term growth.

Major partner collaborations

● Collaborations with telecom and financial service companies to provide customer experiential value

● au Life Insurance with Ponta Points

● Transaction services, including the SMBC Group’s core payment system Olive, a comprehensive financial service for its retail customers

● V POINT insurance program

● Money Forward ME, the No. 1 most-used personal financial management app

● Money Forward Life Insurance with in-app household budget and insurance premium management

● Many years of dementia-related drug discovery and disease awareness activities

● Dementia Insurance “be”

● Leasing, insurance, and other non-banking operations with the Seven & i Group

● Seven Financial Service Life Insurance

- Tech & Services

- Rebranding

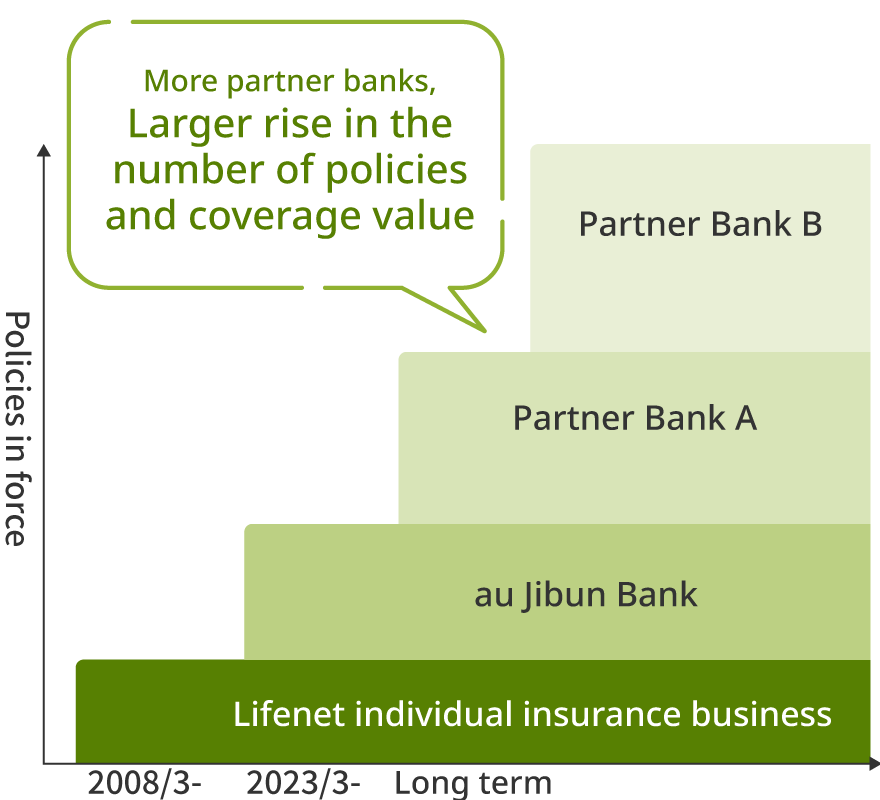

With digitalized financial services becoming increasingly common, we expanded our online insurance operations to include our group credit life insurance business in July 2023. Our first major collaboration was the au Jibun Bank Corporation, a financial business of our partner KDDI Corporation Group, to which we provide group credit life insurance to the bank’s housing loan customers. The au Jibun Bank’s housing loan business has been growing rapidly since its launch in 2015.

We expect the addition of our high-quality insurance products and services to make the bank’s housing loan services even more competitive and support continuing rapid business growth.

● Smartphone app providing convenience of all-in-one deposit, money transfer, settlement, and finance transactions

● Japan’s first net bank to offer online housing loan payments

Group credit life insurance is life insurance policies connected with housing loans and other financing provided by financial institutions. A policy associated with a housing loan, for example, would provide payments to banks or other institutions covering a borrower’s outstanding balances in the event of death or a predetermined state of severe disability.

The borrower, such as the individual who takes out the home loan, is the insured, and the bank or financial institution is the insurance policyholder and beneficiary.

We are actively seeking partnerships with banks to take advantage of the banking industry’s growing use of information technology in their housing loan businesses and to establish online insurance as a core service. More partner banks will increase the volume of policies in force (our business scale), which in turn will enable us to take advantage of economies of scale to further improve our operating efficiency.

Partner banks and business growth

- More partner banks increase policies in force