We have established "Be Sincere, Easy-to-understand, Affordable and Convenient" and "Increase security" as our Materiality for our customers, aiming to "Creating the future for our customers."

“Be Sincere, Easy-to-understand, Affordable and Convenient” is equal to the LIFENET Manifesto (the "Manifesto"), and it is the very reason for our existence.

We aim to be a company that creates the future of life insurance and help our customers embrace life more fully through management with integrity, and offering easy-to-understand, affordable, convenient products and services.

In addressing this materiality, we have established the following indicators based on the recognition that it is important for employees who empathize with our management philosophy, the Manifesto, to achieve customer satisfaction through providing products and services based on the Manifesto, and to achieve business growth and enhance corporate value.

|

Comprehensive Equity*1 |

||

|

FY2022 |

FY2023 |

FY2024 |

|

¥ 133.6 billion |

¥ 159.8 billion |

¥ 167.0 billion |

|

Annualized premium of policies-in-force *2 |

||

|

FY2022 |

FY2023 |

FY2024 |

|

¥ 24,033 million |

¥ 28,750 million |

¥ 34,518 million |

|

Employee engagement scores (Philosophy)*3 |

||

|

FY2022 |

FY2023 |

FY2024 |

|

73 |

72 |

73 |

|

Policyholder recommendation rate *4 |

||

|

FY2022 |

FY2023 |

FY2024 |

|

82.2% |

82.5% |

82.4% |

- For details, please see “Comprehensive Equity”.

- For details, please see “Annualized premium”.

- Employee Engagement Score is a numerical value calculated from an engagement survey that visualizes the state of each employee and the organization, with a maximum value of 100. This indicator is the score for items related to empathy with philosophy and strategy among multiple engagement survey items.

- The percentage of customers who responded "Strongly recommend" or "Somewhat recommend" when asked if they would recommend our products and services to family and friends in a survey conducted among our policyholders. We have adopted the Net Promoter Score® (NPS®) as an indicator of policyholder evaluation and calculate the recommendation rate based on the NPS. The Net Promoter Score is registered trademark or service mark of Bain & Company, Inc., Fred Reichheld and NICE Systems, Inc.

Thorough disclosure of information

We will strive to improve transparency and reliability by disclosing appropriate information to our customers and other stakeholders. We will work to ensure that customers can purchase our insurance with peace of mind, and also to promote understanding of the online life insurance market and our company in the society.

- Load charge rate

We aim for thorough information disclosure and fully disclose the load charge rate, which corresponds to the operating expenses of the life insurance company, within the life insurance premium. We first disclosed this information in 2008, shortly after our establishment, and continue to be the only life insurance company to disclose to this day (as of November 2024).

- Evaluation from our policyholders

We disclose policyholders’ evaluations of our company.

Feedback from our policyholders (Japanese only)

- Payment of insurance claims and benefits

We are committed to the prompt and careful payment of insurance claims and benefits, which is the most important responsibility of a life insurance company. We also disclose our status of claims and benefits.

Insurance claim payment (Japanese only)

- Engagement with shareholders and investors

Based on the Manifesto, we have established an IR Manifesto (IR Policy) since our listing in 2012. We have been actively engaging in dialogue, including with our management team.

IR Policy (IR Manifesto)

- Pursuit of highly transparent corporate governance

Please see Corporate governance to create the future

Simple and easy-to-understand products

Our products specialize in protection with no cancellation refund. We aim to provide simple and easy-to-understand protection, unique to online life insurance, so that customers understand and choose our products. Ultimately, we would like them to take out life insurance policies for a long period of time.

Provision of life insurance knowledge

We promote understanding of life insurance by introducing basic knowledge of life insurance, how to choose insurance, and public support systems.

By utilizing the Internet, we are able to keep our operating costs down and offer competitively priced products. Our affordable premiums make us a popular choice among young customers who are under financial pressure due to factors such as child-rearing.

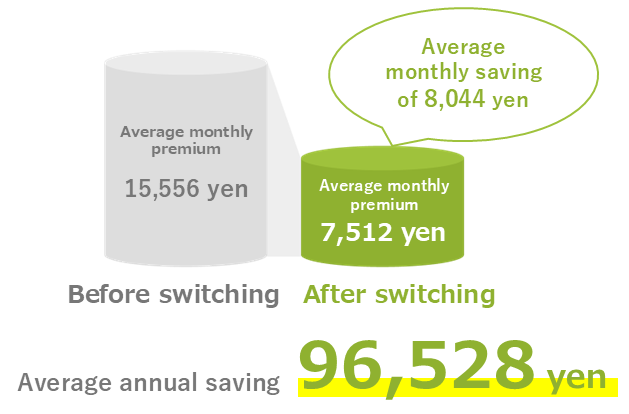

The average amount saved by those who reported reducing their premiums after switching to Lifenet

- Results of the 2023-2025 application questionnaire (258 valid responses)

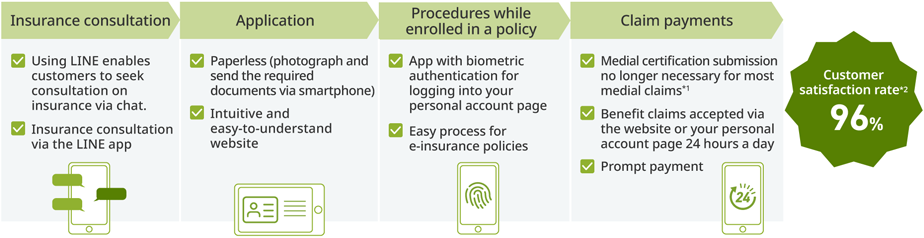

We strive to utilize the Internet at all touchpoints with our customers to provide highly convenient services for them. We are establishing an environment where customers can access services 24 hours a day, 365 days a year, to suit their lifestyles, from insurance consultation to applications, procedures during their contract, and claim benefits. We believe that pursuing convenience reduces the time burden on customers related to life insurance and leads to improved customer satisfaction.

- Medical insurance benefits are applicable. However, a medical certificate may be required under certain conditions.

- Based on a May 2024 policyholder survey (1,594 respondents)

Our products and services have received high evaluations from external organizations.

As an online life insurance company, we consider ensuring information security as one of our top priorities to allow our customers to use our online services with peace of mind.

In addressing this materiality, we have established the following indicators based on the recognition that it is important to obtain major external security certifications and to continuously strengthen information management.

|

Major external security certifications |

||

|

FY2022 |

FY2023 |

FY2024 |

|

- |

In progress |

Obtaining PrivacyMark*1 |

|

Periodic CSIRT activities*2 |

||

|

FY2022 |

FY2023 |

FY2024 |

|

Continuously implemented |

Continuously implemented |

Continuously implemented |

|

Training for executives and employees |

||

|

FY2022 |

FY2023 |

FY2024 |

|

Continuously implemented |

Continuously implemented |

Continuously implemented |

- This mark can be used by private enterprises businesses that have been evaluated by a designated assessment organization as appropriately managing personal information.

- This refers to the monthly activities of the CSIRT (Computer Security Incident Response Team) that centrally manages and responds to cyber security incidents.

From the perspective of the importance of protecting and managing information assets, we have appointed a CISO (Chief Information Security Officer). In order to manage information security risks, we have established internal regulations, developed a risk assessment and improvement system, and set up a committee that includes relevant experts. We also conduct regular reports for the management team.

Our CSIRT* operates under the policy that "every employee plays a leading role" and is composed of members selected from all departments. Under the supervision of the CISO, the team formulates an annual plan and conducts monthly activities.

The CSIRT implements technical security measures, prevents and monitors unauthorized intrusion and misuse in preparation for external attacks. It also conducts training to respond to emergencies.

Through these initiatives, we received the Grand Prize in the Security Measures and Operations Category (Private Sector) at the “Japan Security Awards 2025”. We were recognized for fostering a culture where employees take ownership of security, and for striving to improve awareness and response capabilities across the entire organization.

We received the Grand Prize in the Security Measures and Operations Category (Private Sector) at the Japan Security Awards 2025 (Japanese version only)

- CSIRT: Computer Security Incident Response Team; a team that responds to security incidents.