We are committed to “Corporate governance to create the future” by establishing “Strengthen corporate governance,” “Enhance risk management” and “Respect corporate ethics” in our materiality priority issues.

Given the public nature and sociality of the insurance business, we aim to strengthen corporate governance to ensure management transparency and to enhance the supervision and effectiveness of the management organization system.

In addressing this Materiality, we have established the following indicators base on the recognition of the importance of continuously strengthening the supervisory function of the Board of Directors in order to enhance governance.

|

Continuous implementation of measures to enhance the supervisory function of the Board of Directors |

|

|

FY2023 |

FY2024 |

|

Maintain diversity (4 independent outside directors and 2 female directors out of 10 directors) The Nomination and Compensation Committee is chaired by an outside director and maintains a majority of outside directors (4 out of 5) Initiatives related the skills item of the Board of Directors skills (reviewed the skills required, disclosed the reasons for selecting skill items and the correlation of skill items with the new management policy and mid-term business plan) Held Outside Directors' Meetings*1 4 times a year Discussed the nature of the Board of Directors in preparation for the transition to a monitoring board |

|

|

Ratio of Independent Outside Directors*2 |

|

|

FY2023 |

FY2024 |

|

40% |

57% |

- The Outside Directors' Meeting is a voluntary meeting consisting of outside directors that holds discussions based on the evaluation of the effectiveness of the Board of Directors.

- At the Board of Directors meeting held after the 19th Annual General Meeting of Shareholders (June 2025), the ratio of female directors is 29% (2 out of 7), and the ratio of independent outside directors is 57% (4 out of 7).

Based on our mission: Help our customers embrace life more fully through management with integrity, and offering easy-to-understand, affordable, convenient products and services, as given the public nature and sociality of the insurance business, we aim to promote sustainable growth in corporate value, with strengthening and enhancing corporate governance through emphasizing management transparency, monitoring a management structure and improving effectiveness of the structure.

|

2008 (Business opening) |

Formed the Board of Directors with Outside Officers serving as a majority of all officers |

|

2011 |

Introduced an executive officer system |

|

2016 |

Established the discretionary Nomination and Compensation Committee The chairperson: independent outside director The members: independent outside director comprising a majority of its members Started evaluating the effectiveness of the Board of Directors |

|

2019 |

Introduced restricted stock compensation as officer compensation |

|

2020 |

Expanded evaluation of the effectiveness of the Board of Directors |

|

2021 |

Transitioned from being a company with a board of corporate auditors to a company with an audit and supervisory committee Introduced performance-linked compensation as officer compensation Disclosed a skills matrix of Directors |

|

2022 |

Revised the transfer restriction period for the restricted stock compensation system |

|

2023 |

Revised the performance-linked compensation (newly adopted non-financial indicators) Expanded evaluation of the effectiveness of the Board of Directors |

|

2024 |

Changed the composition of the board of directors to a system where the majority are independent outside directors (transition to a monitoring board) Enhanced the skills matrix of Directors |

We have adopted a company with an audit and supervisory committee to strengthen the supervisory function of the Board of Directors and corporate governance.

|

Organizational form |

Company with an audit and supervisory committee |

|

|

Chairperson of the Board of Directors |

President and Representative Director |

|

|

the Board of Directors |

Members |

7 |

|

% of Independent Outside Directors |

57% (4 out of 7) |

|

|

% of female directors |

29% (2 out of 7) |

|

|

Audit and Supervisory Committee |

Members |

3 |

|

% of Independent Outside Directors |

100% (3 out of 3) |

|

|

Others |

Nomination and Compensation Committee, Board of Executive Officers, Risk Management Committee, Compliance Committee, Sustainability Committee |

|

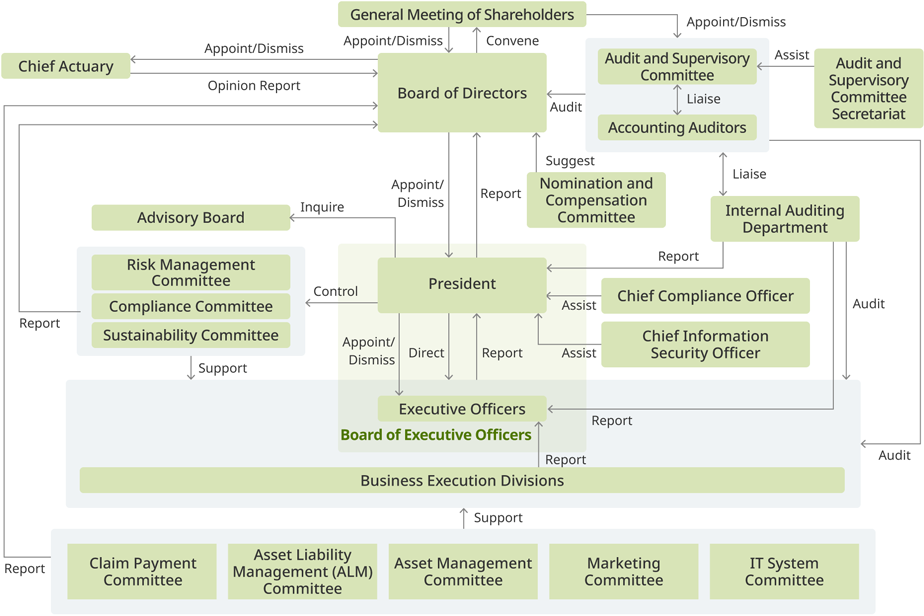

Corporate governance structure

The Board of Directors makes key management decisions and supervises the execution of business operations in accordance with the Rule of Board of Directors. In principle, the Board of Directors meets monthly, and extraordinary meetings are held as necessary.

With the aim of strengthening the supervisory function of the Board of Directors and further separating the supervisory and executive functions, the majority of the Board of Directors is composed of independent outside directors. In addition, the percentage of female directors on the Board of Directors is 29%, ensuring diversity.

Ratio of Independent Outside Directors

57%

(4 out of 7)

Ratio of female directors

29%

(2 out of 7)

The following is a content of the main discussions and reports made by the Board of Directors during FY2024.

- Matters related to the formulation of mid-term business plans and budgets

- Sustainability matters

- Matters related to IR

- Corporate governance matters

- Matters related to the evaluation of the effectiveness of the Board of Directors

- Matters related to nomination and compensation of directors and appointment of executive officers

- Matters concerning the status of internal control system

- Compliance matters

- Risk management matters

- Matters concerning complaints and consultations from customers

- Matters related to internal audit

- Financial Results

- Matters related to subsidiary management

- Other important matters related to laws and regulations, and the Articles of Incorporation, etc.

In order to ensure the effectiveness and appropriateness of the Board of Directors, we have conducted an evaluation of the effectiveness of the Board of Directors once a year in principle since FY2016.

The results of the evaluation are reported to the Board of Directors, where deliberations are held and improvement plans are formulated to further enhance the functions of the Board of Directors.

We also evaluate the overall governance system, including the Audit and Supervisory Committee, the voluntary Nomination and Compensation Committee, and the Outside Directors' Meeting. Please see the overview of the evaluation results below.

We have established a discretionary Nomination and Compensation Committee to strengthen the independence, objectivity and accountability of the functions of the Board of Directors concerning the nomination, dismissal, and compensation of officers. The Board of Directors enacts the nomination and dismissal policy of officers upon deliberations by the Nomination and Compensation Committee.

It is important for the Board of Directors to perform its roles of making important management decisions and supervising the execution of duties by Directors to realize our Mission. The policy on the composition of the Board of Directors to appropriately perform its roles is as follows.

We disclose the knowledge, experience and abilities of each Director in a skills matrix based on our business and management strategies to ensure the effectiveness of the Board of Directors.

Skills matrix of Directors (As of June, 2025)

|

Name |

Position |

Knowledge, experience and abilities of the Directors |

||||||

|

Corporate management and sustainability |

Financial services |

Technology |

Marketing and alliance |

Human capital and corporate culture |

Accounting and engagement with capital markets |

Legal affairs, risk management and governance |

||

|

Junpei Yokozawa |

President and Representative Director |

● |

● |

● |

||||

|

Takeshi Kawasaki |

Director, Executive Vice President CFO |

● |

● |

● |

● |

● |

||

|

Jun Hasebe |

Outside Director |

● |

● |

● |

● |

|||

|

Hiro Koya |

Outside Director |

● |

● |

● |

||||

|

Emima Abe |

Outside Director (Audit and Supervisory Committee Member) |

● |

● |

|||||

|

Tomoyuki Yamashita |

Outside Director (Audit and Supervisory Committee Member) |

● |

● |

● |

● |

● |

● |

|

|

Natsuyo Hara |

Outside Director (Audit and Supervisory Committee Member) |

● |

● |

● |

● |

● |

||

- The above table does not represent all the knowledge, experience and abilities of the Directors.

We reviewed the knowledge, experience and abilities required for the Board of Directors in order for the Board of Directors to perform its roles of making important management decisions and supervising the execution of duties by Directors to realize the Management Policy and FY2028 mid-term business plan.

The relationship between the Management Policy and the medium-term business plan and the skills items, and the reasons for selecting the skills items are as follows.

Relationship between Management Policies, Mid-term business plan and skill items

|

Management Policy |

Mid-term business plan |

Management foundation |

|||

|

Priority areas |

Human capital strategy |

||||

|

Tech & Services |

Rebranding |

Embedded |

|||

|

Corporate management and sustainability |

Technology |

Marketing and alliance |

Human capital and corporate culture |

Accounting and engagement with capital markets |

|

|

Financial services |

Legal affairs,risk management and governance |

||||

Reasons for selection of each skill

|

Skills |

Reasons for selection |

|

Corporate management and sustainability |

We believe that promoting sustainability initiatives along with corporate management will contribute to the realization of a sustainable society and the enhancement of our corporate value. |

|

Financial services |

It is necessary to formulate a sustainable growth strategy and understand the business environment because we are engaged in the financial sector. |

|

Technology |

We are a life insurance company that operates businesses centered around the Internet. In the Internet-related market, technological innovation and changes in customer needs occur very quickly, and it is necessary to constantly grasp the latest technological trends and environmental changes and respond accordingly. |

|

Marketing and alliance |

As a leading online life insurance company, it is necessary to offer products and services to more customers in order to realize further expansion of the online life insurance market. |

|

Human capital and corporate culture |

It is essential that we focus even more on our human capital, which is the driving force behind our company, in order to realize the Manifesto, the Company's philosophy. We need to improve our human capital development, build a better organization and increase engagement through a shred understanding of our company culture. |

|

Accounting and engagement with capital markets |

In order to realize sustainable growth as a listed company, it is necessary to build a strong financial base, as well as to conduct continuous investment and active dialogue with shareholders and investors. |

|

Legal affairs, risk management and governance |

It is necessary to build a compliance system based on strong ethical standards, appropriately manage risks, and further strengthen corporate governance in order to realize sustainable growth as a life insurance company. |

The amount of individual compensation for directors who are not audit and supervisory committee members is determined by the Board of Directors after deliberation by the discretionary Nomination and Remuneration Committee. This is based on consideration of the duties and responsibilities of each director, as well as surveys of the remuneration levels of domestic company executives by third parties.

In addition, performance-linked compensation is determined based on the amount calculated based on the fixed compensation amount. The amount of compensation is determined according to the degree of achievement of the targets related to the financial indicators (the corporate value improvement, etc.) and non-financial indicators (the customer satisfaction, etc.) set by the Board of Directors.

The amount of individual compensation for directors who are members of the audit and supervisory committee members is determined through discussions at the Audit and Supervisory Committee. In order to ensure that the role of the Committee functions fully, audit and supervisory committee members receive only fixed compensation.

|

Directors*1 |

No more than 250 million yen per year |

Fixed compensation |

Performance-linked compensation |

Restricted Stock compensation |

||

|

Internal directors |

〇 |

〇 |

〇 |

|||

|

Approximate Compensation Ratio |

6 |

1 |

3 |

|||

|

Internal directors |

〇 |

|||||

|

Directors (the Committee*2 members) |

No more than 50 million yen per year |

〇 |

||||

- Directors who are not audit and supervisory committee members

- Audit and supervisory committee

|

Fixed compensation |

Fixed monetary remuneration determined in consideration of each director's duties and scope of responsibility, etc. |

|

Performance-linked compensation |

Variable monetary compensation to reward contributions to the business's performance in a single fiscal year as a mechanism to raise directors' awareness of the need to improve business performance and increase corporate value. |

|

Restricted Stock compensation |

Stock-based compensation (up to 200,000 shares per year) to provide incentives to sustainably increase corporate value and to promote further value sharing with shareholders |

Total amount of compensation and others for Fiscal Year 2024

|

Category |

Total amount of compensation (JPYmn) |

Total amount of compensation by type (JPYmn) |

Number of directors |

||

|

Fixed compensation |

Performance-linked compensation |

Restricted stock compensation |

|||

|

Directors*1 (outside directors) |

131 (7) |

74 (7) |

18 (-) |

38 (-) |

5 (1) |

|

Directors (the Committee*2 members) (outside directors) |

25 (21) |

25 (21) |

- |

- |

4 (3) |

|

Total (outside directors) |

156 (28) |

100 (28) |

18 (-) |

38 (-) |

9 (4) |

- Directors who are not audit and supervisory committee members

- Audit and supervisory committee

Based on the Rule of the Audit and Supervisory Committee, the Audit and Supervisory Committee (the Committee) receives reports regarding significant issues related to audit. It consists of three Directors including chairperson of the Committee (all independent and outside Directors). In addition, the Committee Secretariat (the Secretariat) assists the Committee in its duties. Based on auditing policies and plans determined by the Committee, the head of the Secretariat under the direction of the Committee attends the Board of Directors and other significant meetings, interviews Directors (excluding Directors who are the Committee Members) and Representatives of each business division and audits the Company's operations and assets. The head of the Secretariat keeps close collaboration with Accounting Auditors and the Internal Audit Division, receiving reports from them. The head of the Secretariat monitors business execution by the Directors accordingly and reports the Committee with additional congregations as deemed necessary.

We have established the discretionary Nomination and Compensation Committee (the Committee) with the aim of strengthening the independence and objectivity and its accountability of the Board of Directors’ functions related to the nomination and compensation of Directors, and the design of the executive compensation system.

The committee deliberates on the election and dismissal of directors (including audit and supervisory committee members), the selection and dismissal of representative directors and directors with specific titles, the system of executive compensation, and the details of individual compensation for directors, and then makes proposals to the Board of Directors.

The Committee consists of all four independent outside directors and one representative director as determined in advance by the Board of Directors.

The Committee chairperson is selected by mutual vote from among the independent outside directors.

The following is a content of the main discussions and reports made by the Nomination and Compensation Committee during FY2024.

- Election of candidates for directors who are not audit and supervisory committee members

- Election of candidates for directors who are audit and supervisory committee members

- Targets and evaluation items for internal directors

- Composition of the Board of Directors

- Succession plan

- Review of the skills matrix (change of skills items, reasons for selecting the items)

- Executive Compensation for Fiscal Year 2024

- Executive compensation for the current fiscal year and the following fiscal year and beyond

Under the monitoring of the President and Representative Director, we have established an Audit Department (Internal Audit Division) that is independent of the audited departments. The department is separate from all other lines of business execution, enabling it to conduct internal audits from an independent and objective standpoint. It examines and evaluates operational adequacy, risk management effectiveness, and the status of legal compliance, and makes recommendations for improvements as needed. The results of internal audits are reported to the President and Representative Director, the Board of Directors, and Audit and Supervisory Committee (the Committee).

The department also has regular and additional meetings with the accounting auditors. At these meetings, it collaborates closer, by exchanging ideas regarding the status of accounting audits, reporting about the status of main internal audit and providing internal audit report.

Furthermore, the department also provides internal audit reports to the Committee or head of the Committee Secretariat based on Supervisory Standards.

We have established the Compliance Committee, Risk Management Committee, Sustainability Committee, Claim Payment Committee, Marketing Committee, Asset Management Committee, ALM Committee, and System Committee for the purpose of obtaining useful advice on important management matters. These committees primarily serve an advisory function to the business execution departments. The Compliance Committee, Risk Management Committee, and Sustainability Committee are chaired by the President and Representative Director.

We have established the Board of Executive Officers to separate decision-making and supervision from business execution and strengthen the decision-making function.

Executive officers execute their duties in accordance with the responsibilities assigned to them by the President and Representative Director. In principle, the Board of Executive Officers is held once a week.

The Board is attended by the President and Representative Director, who chairs the meeting, and seven executive officers (including one concurrently serving as a director). The head of the Audit and Supervisory Committee Secretariat also attends the Board.

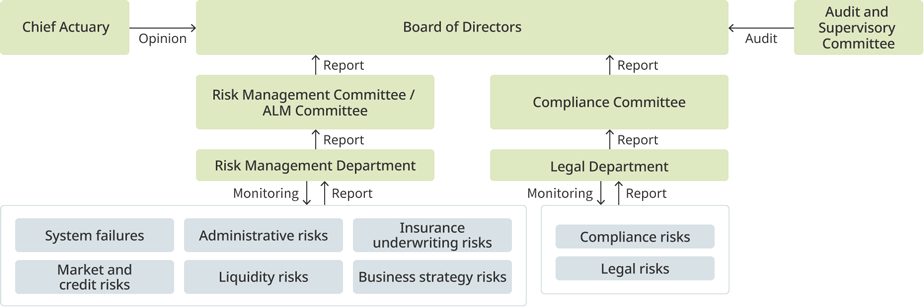

We recognize that the development and establishment of a risk management system is extremely important for management in order to realize our risk strategy while ensuring the financial soundness and appropriateness of our operations as a life insurance company.

In order to further enhance risk management through continuous monitoring, the indicators are to hold regular meetings of the "Risk Management Committee" chaired by the President and Representative Director, and to implement the PDCA*1 cycle for dealing with risks to be managed.

- Stands for Plan-Do-Check-Act

|

-Holding of regular meetings of the Risk Management Committee -Implementation of the PDCA cycle for risk management initiatives |

|

|

FY2023 |

FY2024 |

|

|

We have set a basic approach to risk management in its "Basic Policy on Risk Management." We have established an internal organizational structure to assess and improve each risk. Our subsidiary applies these basic ideas on risk management for appropriate business operations.

We have designated primary risk management departments for each risk to be managed, with the Risk Management Department serving as the secondary risk management department. In addition, based on the belief that cross-organizational efforts are effective for comprehensive risk management, we have established a "Risk Management Committee" composed of relevant officers and department heads. Furthermore, based on the recognition that comprehensive management of assets and liabilities is the cornerstone of risk management for a life insurance company, the ALM*1 Committee has been established separately from the Risk Management Committee. In order to promote the development and operation of internal control systems, we have established the Compliance Committee, which is a cross-organizational body that discusses and follows up on the development and promotion of compliance systems, consisting of relevant directors and division heads.

- Asset Liability Management

For more information, please see the Securities Report (Japanese version only)

Based on the fact that we have great social responsibility and public mission as a life insurance company and the Manifesto, we have set as a material issue for our executives and employees to strictly comply with laws and regulations to ensure sound and appropriate business operations and fairness in insurance solicitation.

The indicator is based on the regular holding of the Compliance Committee and the implementation of appropriate PDCA cycles in response to compliance issues.

The Compliance Committee is responsible for ensuring that information regarding compliance with laws and regulations, including information regarding insurance solicitation management systems and customer protection management systems, is recognized and understood in a timely and accurate manner, and that this information is shared among relevant officers and employees.

|

-Holding of regular meetings of the Compliance Committee -Implementation of the PDCA cycle for compliance initiatives |

|

|

FY2023 |

FY2024 |

|

|

|

Ongoing compliance training for employees |

|

|

FY2023 |

FY2024 |

|

Continuously implemented |

Continuously implemented |

We have established the Basic Policy on Compliance with Laws and Regulations, and work to develop compliance and promote the system.

We have formulated a "Compliance Manual" that specifically explains the laws and regulations to be complied with, and shares its contents with officers and employees.

In addition, we formulate a "Compliance Program," which is a practical compliance plan, each year and provides appropriate guidance and management in accordance with this Program. Furthermore, we have established the "Compliance Committee" as a cross-organizational body for timely and accurate recognition and understanding of compliance-related information. In principle, the Compliance Committee meets once every three months and reports its findings to the Board of Directors.

It is expressly stipulated that any director, officer, or employee may report any suspected compliance violation to the Legal Department, the Audit and Supervisory Committee, or the contact point stipulated in the Internal Reporting Rules. We will not treat the reporter in any disadvantageous manner because of his/her report.

We have introduced a whistleblowing system to secure and increase social trust as a life insurance company through the early detection and rectification of illegal activities and protection of whistleblowers.

Not only our officers and employees but part-time and temporary workers can utilize the system. We protect anonymity unless we have the consent of the whistleblower. Furthermore, the safety of whistleblowers is ensured so that they are not subjected to disadvantageous handling by the company.

We have established Conflict of Interest Management Policy (Japanese only) and strive to manage conflict of interest transactions by ensuring that our officers and employees comply with this policy so that the interests of our customers are not unfairly impaired.

As a life insurance company with a high public nature, we have established the “Basic Policy against Antisocial Organizations (Japanese only)" to prevent our stakeholders from being harmed by antisocial organizations.