Our company values the concept of mutual aid, which is the foundation of life insurance, in our approach to sustainability as well.

We believe that continuing to create new value in life insurance, while valuing the mutual relationships with our various stakeholders, will contribute to a sustainable future while enhancing our corporate value.

Based on this belief, we have established the following Basic Sustainability Policy with the approval of the Board of Directors.

<Basic Sustainability Policy>

- The Company establishes the Basic Sustainability Policy, acknowledging the significance of implementing sustainability-focused management at the group level to achieve a sustainable society and environment, as well as to enhance the Company's medium- to long-term corporate value.

- The Company undertakes initiatives to contribute to a sustainable society and environment and to enhance its medium- to long-term corporate value through its corporate activities. This is based on the recognition that operating the business in accordance with the LIFENET Manifesto while maintaining insights into the original purpose of life insurance as mutual support leads to the resolution of social issues.

- The Company undertakes initiatives for various stakeholders including society and responses to global environmental issues. The Company also continuously strengthens its governance as a foundation for corporate management to promote sustainability.

- The Company delivers products and services to support the security of society and individuals including future generations.

- The Company adheres to the "Basic Policy on Compliance with Laws and Regulations," conducts its operations with integrity, and prioritizes ethical considerations, in consideration of the public nature and social responsibility inherent in the insurance industry, as well as the importance of policyholder protection.

- The Company values diversity and provides opportunities for professional challenges and growth to each employee.

- The Company fulfills its corporate social responsibility by implementing environmentally conscious practices as a global citizen in addressing global environmental issues.

- The Company establishes governance and internal systems to promote sustainability, develops pertinent regulations, and actively encourages awareness related to sustainability within the organization.

- The Company recognizes societal expectations and requirements through dialogue with various stakeholders. It endeavors to provide appropriate information disclosure regarding sustainability-related matters, such as global environmental issues, human capital, and governance, to fulfill its accountability as a corporate entity.

Established October 2024

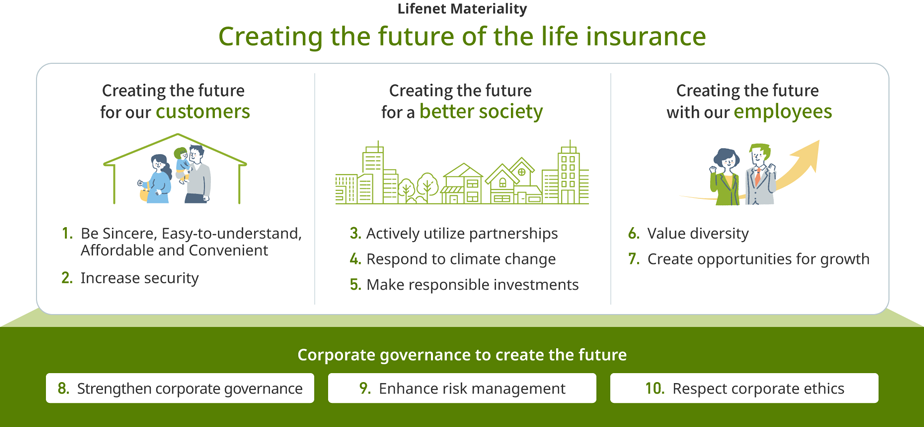

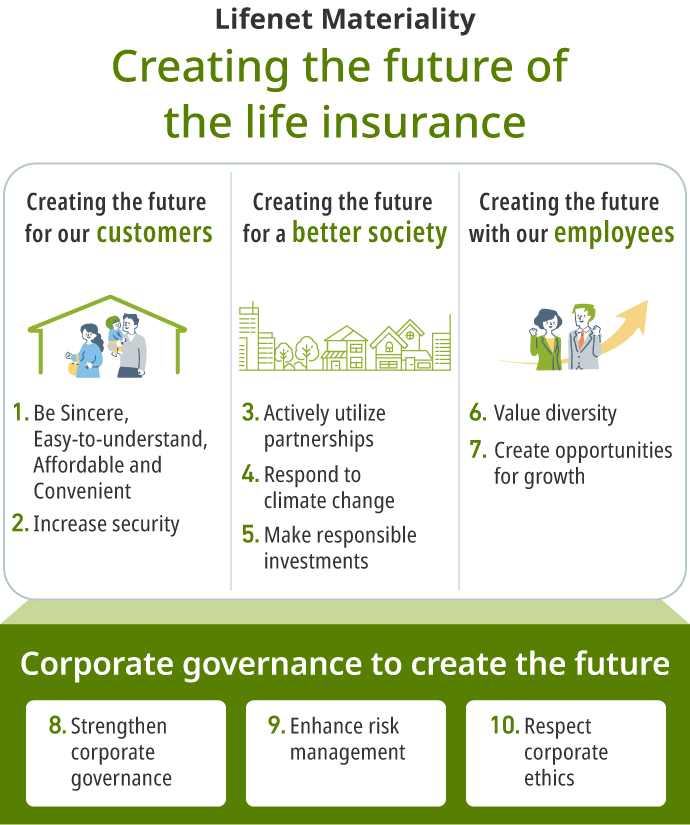

We have identified materiality (priority sustainabiliy issues) that should be addressed over the long term with the aim of achieving a sustainable society and improving corporate value. Under the theme of “Creating the future of the life insurance,” we recognize the following items 1 to 10 as our materiality. We will promote initiatives for our stakeholders, including “customers,” “society” and “employees,” as we continue to enhance “corporate governance,” which is the foundation of our management.

Based on the “LIFENET Manifesto” and our Management Policy, we extract issues by referring to the opinions of shareholders and investors, guidelines including the Sustainability Accounting Standards Board (“SASB”), and evaluation criteria of ESG-rating organizations.

Among the extracted issues, selection for possible materiality is made from two viewpoints: importance to stakeholders and importance to Lifenet.

Identify materiality through discussions at the Board of Directors and Management Meetings. The materiality items are reviewed annually and revised as necessary based on changes in the external environment and our business environment.

For details on each risk listed under "Major Risks," please refer to pages 23 to 30 of the Securities Report.

-

Securities Report (Japanese only)

(1,495KB)

Securities Report (Japanese only)

(1,495KB)

|

Business Environment |

Risks |

Overview of opportunities and risks |

Related Materiality |

|

Advances in digital technology |

|

|

1. Be Sincere, Easy-to-understand, Affordable, and Convenient 3. Actively utilize partnerships 9. Enhance risk management 10. Respect corporate ethics |

|

Demographic changes |

|

|

1. Be Sincere, Easy-to-understand, Affordable, and Convenient 3. Actively utilize partnerships

|

|

Diversification of consumer lifestyles |

|

|

1. Be Sincere, Easy-to-understand, Affordable, and Convenient 3. Actively utilize partnerships

|

|

Changes in the competitive environment |

|

|

1. Be Sincere, Easy-to-understand, Affordable, and Convenient 3. Actively utilize partnerships |

|

Human resources |

|

|

6. Value diversity 7. Create opportunities for growth |

|

Information security |

|

- |

2. Increase security 9. Enhance risk management

|

|

Corporate Governance and Compliance |

|

|

8. Strengthen corporate governance 9. Enhance risk management 10. Respect corporate ethics |

|

Investment and financing |

|

|

5. Make responsible investments |

|

Climate change |

4. Respond to climate change |

The list of indicators linked to each materiality is as follows:

-

List of Materiality indicators

(378KB)

List of Materiality indicators

(378KB)

Policies and initiatives related to sustainability are discussed and reported at the Executive Officers Meeting, which consists of the Chairperson (who is the President and Representative Director) and Executive Officers (including those who concurrently serve as Directors). Important matters are reported to the Board of Directors.

The Board of Directors discusses and supervises the company's sustainability initiatives and other related efforts from the perspective of enhancing medium- to long-term corporate value.

In addition, the Risk Management Committee, chaired by the President and Representative Director and composed of relevant executives and department heads, manages risks related to overall business operations, including sustainability aspects. The content of discussions in the Risk Management Committee is reported to the Board of Directors.

Furthermore, we established a Sustainability Committee in October 2024 in order to promote sustainability initiatives in the future. The Sustainability Committee is chaired by the Representative Director and President, and its members consist of internal directors and executive officers, as well as employees involved in sustainability promotion who are appointed by the chairperson.

Based on changes in the external environment and the expectations and requests of stakeholders, the Committee will discuss and provide advice on matters that contribute to the sustainability of society and the environment and to the enhancement of the corporate value, including policies and systems for promoting sustainability-related initiatives and matters related to materiality, from a company-wide perspective, and report to the Board of Directors.