We have established "Actively utilize partnerships," "Respond to climate change," and "Make responsible investments" as our Materiality for the society, aiming to “Creating the future for a better society.”

In order to expand the online life insurance market and bring the value of the LIFENET Manifesto offerings to more customers, we believe it is important to work with partners who emphasize our purpose.

In addressing this materiality, we have established as indicators the realization of alliances with new partners and the deepening of efforts with existing partners, based on the belief that the promotion of collaboration with partners is important for the sustainability of society and the enhancement of our corporate value.

|

Collaboration with partner companies |

||

|

FY2022 |

FY2023 |

FY2024 |

|

|

|

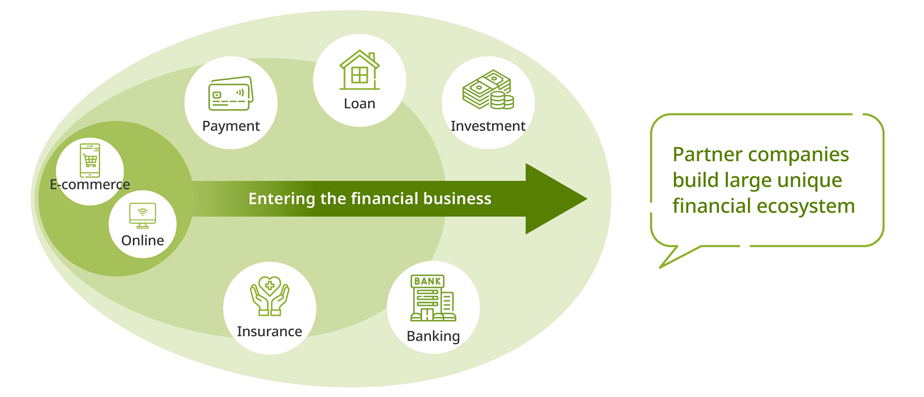

In addition to delivering the value of our Manifesto-based products and services to more customers, we are promoting alliances with partner companies, recognizing that collaboration beyond the boundaries of corporate groups will contribute to solving social issues. “Embedded" is one of the priority areas in our mid-term business plan, and we aim to provide highly convenient financial services to our customers and society by embedding insurance into the financial ecosystem of our partner companies.

In order to provide quality online life insurance services, we believe it is important to work with a variety of partners. This includes not only the partners with whom we work together to promote our business strategies, but also the trading companies that support our day-to-day operations. By leveraging our respective expertise and strengths and cooperating with each other, we aim to create services of greater social and economic value.

In order to provide quality online life insurance services, we believe it is important to work with a variety of partners. This includes not only the partners with whom we work together to promote our business strategies, but also the trading companies that support our day-to-day operations. By leveraging our respective expertise and strengths and cooperating with each other, we aim to create services of greater social and economic value.

We believe that climate change has the potential to affect the business environment from a medium- to long-term perspective. We will promote disclosure in accordance with the framework proposed by the Task Force on Climate-related Financial Disclosures (TCFD).

We discuss and report our sustainability policies and initiatives, including climate change, to the Executive Board of Directors, and report any important matters to the Board of Directors.

The Board of Directors discusses and supervises our sustainability initiatives from the perspective of improving corporate value over the medium- to long-term. In addition, the Risk Management Committee manages risks related to overall business risks, including sustainability perspectives such as climate change, and reports the discussions at the Committee to the Board of Directors.

We recognize the risks and opportunities related to climate change as follows. To properly assess the impacts of climate change, we analyze changes in our business environment under two scenarios: one in which the transition to a low-carbon economy progresses, and another in which insufficient reductions in greenhouse gas (GHG) emissions lead to accelerated temperature rise.

The time horizons in which each risk and opportunity is expected to occur are defined as: Short-term (up to around 3 years), Medium-term (around 3 to 10 years), and Long-term (over 10 years). Furthermore, the impact level of each risk and opportunity is classified into three levels (Large, Medium, and Small) based on a comprehensive assessment of the anticipated business and financial impacts.

The above risks related to climate change are reported at the Risk Management Committee and discussed at the Executive Committee before being reported to the Board of Directors.

For details, please see Risk Management System.

We have promoted paperless and reduced paper resources while pursuing convenience for consumers and productivity of our operations through online business.

In addition, we contribute to the reduction of greenhouse gas emissions (GHG emissions) by having no branches or sales offices. While we have not set any targets based on our business model and scale, we recognize the potential impact of climate change on the life insurance industry as a business risk, and will consider measures to be taken in the medium- to long-term.

The following shows the GHG emissions of the Lifenet Group, including Scope 1 (emissions directly generated by the company) and Scope 2 (emissions associated with the use of electricity supplied by other companies). Note that the Scope 2 emissions for FY2024 increased from FY2023 due to the impact of the head office relocation, as well as the inclusion of electricity consumption from a newly added data center (Ashigarakami-gun, Kanagawa Prefecture) in the calculation.

GHG emissions (Scope 1 and Scope2)

(t-CO2)

|

FY2022*1 |

FY2023*2 |

FY2024*3 |

|

|

Scope1 |

25.6 |

24.5 |

23.1 |

|

Scope2*4 |

79.7 |

233.8 |

411.1 |

|

Total*5 |

105.4 |

258.3 |

434.2 |

- The figures for FY2022 (April 2022 to March 2023) are calculated based on electricity and city gas consumption at the head office (Kojimachi NK Building). The scope of this performance includes Lifenet and its consolidated subsidiary Lifenet Mirai Inc.

- The figures for FY2023 (April 2023 to March 2024) includes the electricity consumption of the data center (Osaka City, Osaka Prefecture) in addition to the scope of FY2022.

- For FY2024 (April 2024 - March 2025), the calculation includes the electricity consumption from a newly added data center (Ashigarakami-gun, Kanagawa Prefecture). The figures also include electricity consumption from both the previous head office (Kojimachi NK Building) and the new location (Nibanchō Center Building) due to the office relocation in November 2024.

- Scope 2 emissions are calculated based on the market standard in the GHG Protocol.

- The electricity consumption for our data centers (Osaka City, Osaka Prefecture, and Ashigarakami-gun, Kanagawa Prefecture) is calculated based on contracted power supply and may differ from the actual electricity consumption of our group.

Since payment of insurance claims and benefits is the most essential social responsibility of a life insurance company, we believe it is important to safely and securely invest the premiums received from our policyholders.

We also express our support for and acceptance of the "Asset Owner Principles" published by the Cabinet Secretariat in July 2025. As an asset owner, we are committed to fulfilling our responsibility to manage our clients' assets by pursuing their best interests, and we will strive to manage our assets based on these principles.

We have set the solvency margin ratio, which indicates the ability of insurance payment, as an indicator to properly pay insurance claims and benefits. We also use the implementation of ESG-conscious investment as an indicator from the perspective of business characteristics and social sustainability.

|

Maintain a sound consolidated solvency margin ratio |

||

|

FY2022 |

FY2023 |

FY2024 |

|

3,173.1% |

2,192.9% |

1,722.2% |

|

Implement negative screening |

||

|

FY2022 |

FY2023 |

FY2024 |

|

Continuously implemented |

Continuously implemented |

Continuously implemented |

We have established a solid asset management policy and continue to invest mainly in government bonds and corporate bonds with high credit ratings to reliably and appropriately pay insurance claims and benefits.

Currently, based on our asset management policy, investment portfolio and investment scale, we do not have a clear ESG (Environment, Social and Governance) investment policy at this time. However, from the perspective of the characteristics of life insurance business and social sustainability, we make ESG-conscious investments based on certain discipline, taking into account investment performance and risks.

Status of asset management