Introducing the strengths of Lifenet, which continues to be a leading online life insurance company.

Our products are all protection-type insurance, distinguished by their simple and easy-to-understand coverage and affordable premiums. Our business model is not a conventional "push-type" insurance sales model, but rather a "pull-type" business model that is customer-oriented, and we have designed our products to be easy to understand so that customers can understand and select them themselves.

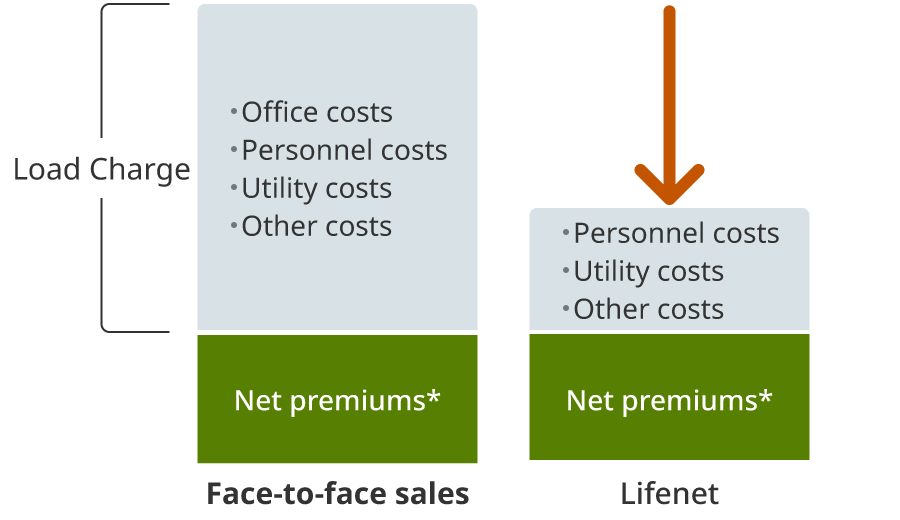

Traditionally, life insurance has been sold mainly through sales representatives. Consequently, the costs of personnel, stores, and other expenses are ultimately passed on to customers in the form of insurance premiums. In contrast, by selling our products over the Internet, we significantly reduce these overhead costs, enabling us to provide at low premiums.

Structure of premium (Term life insurance)

- Used for insurance payouts

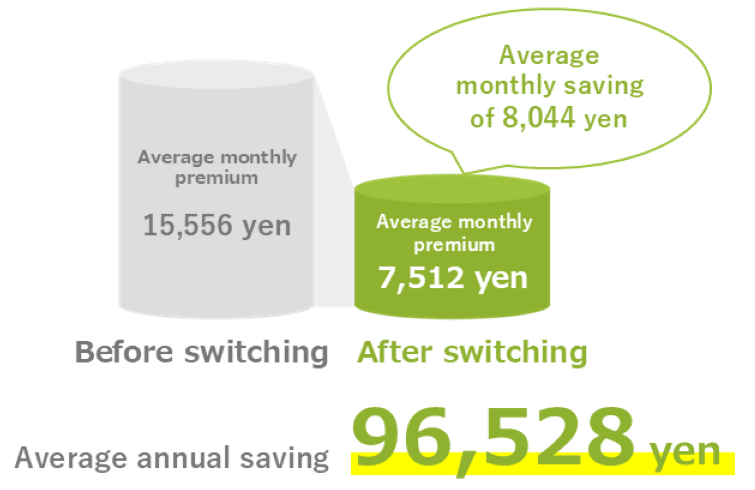

By reducing sales costs, we have been able to save our customers approximately 100,000 yen per year in insurance premiums, and we offer products with price advantages in long-term insurance contracts.

The average amount saved by those who reported reducing their premiums after switching to Lifenet*1

- Results of the 2023-2025 application questionnaire (258 valid responses)

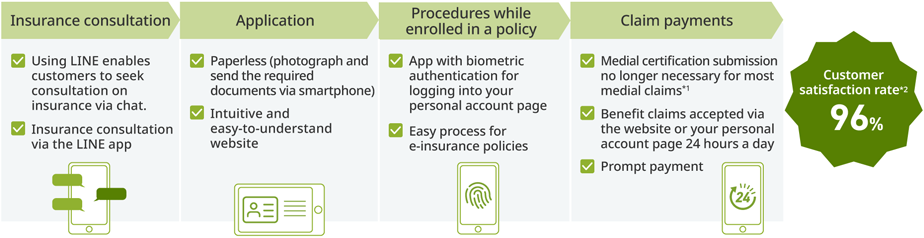

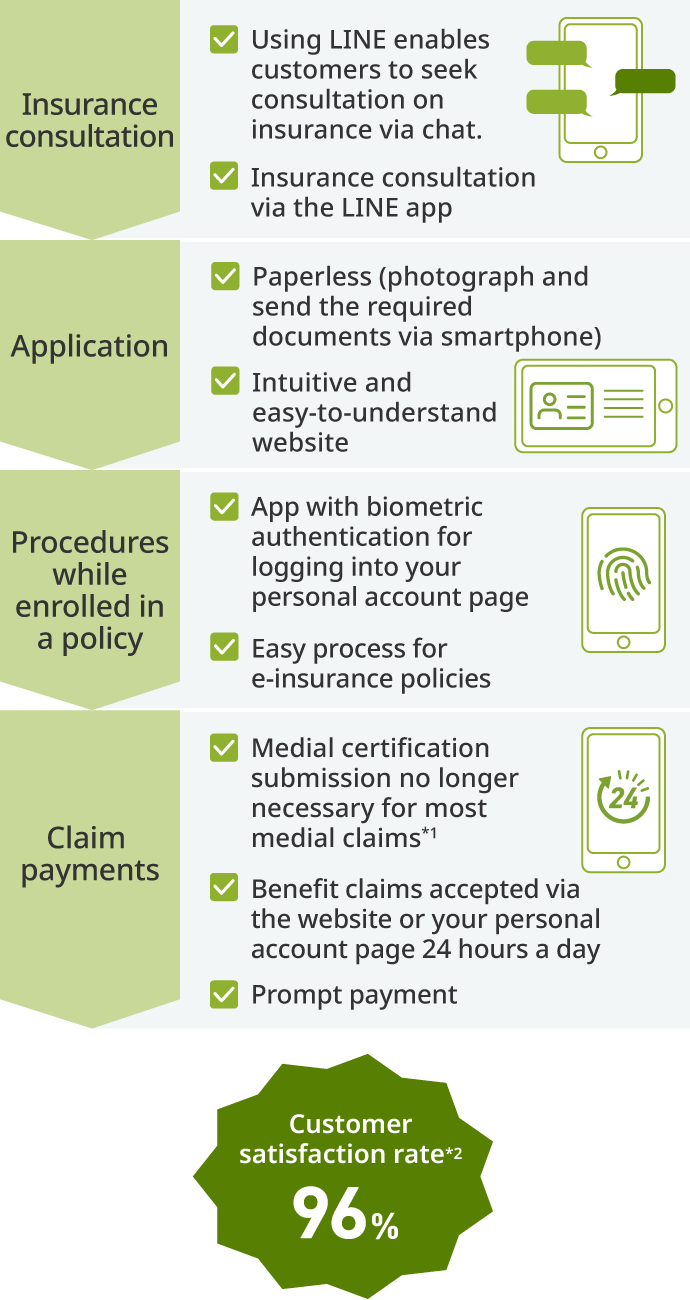

Recognizing that our website is our primary customer interface and essentially the “face” of our company, we have been dedicated to enhancing our UI/UX since our launch.

With intuitive smartphone usability and clear information design, we have established an environment where customers can consult, apply, and claim benefits 24 hours a day, 365 days a year, fitting their lifestyles.

In our mid-term business plan announced in 2024, we have designated "Tech & Services" as one of priority areas and are continuously to further refine our UI/UX from the customer's perspective.

Full smartphone accessibility from choosing a policy to claim payments

Full smartphone accessibility from choosing a policy to claim payments

- It is possible to omit the medical certification submission only for medical insurance. The submission is required under certain conditions.

- Source from the survey in May 2024 (Respondents: 1.594)

The source of our competitive advantage lies in an organizational culture that create innovation, driven by a diverse workforce united by their empathy for our management philosophy, the "LIFENET Manifesto."

We have a deeply rooted culture where everyone, regardless of position or tenure, exchanges opinions freely, embraces challenges, and view failures as a learning opportunity.

Building on this solid organizational foundation, we continuously create new value from the customer's perspective, including industry-first initiatives and services that transcend the frameworks of traditional life insurance.

Percentage of mid-career hires from other industries*1

From outside the life insurance industry

61%

- As of end-March 2025, the percentage of mid-career hires from outside the life insurance industry.

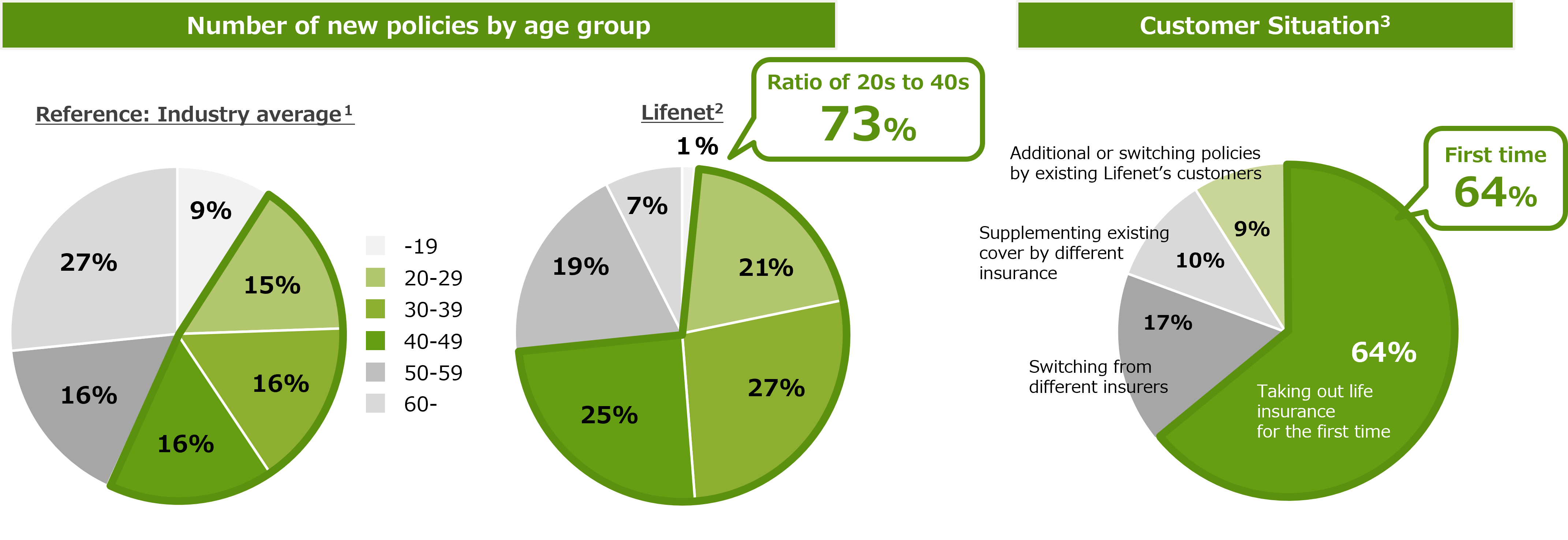

Our online-focused customer experience resonates strongly with younger generations who prefer digital services. In contrast to the industry average of 50%, over 70% of our new policyholders are in their 20s to 40s. By providing the coverage that need as their life stages change and building long-term relationships with these customers, we have established a stable, long-term revenue base.

Furthermore, more than half of our customers choose Lifenet for their very first insurance policy. Even in Japan's life insurance market, where the household penetration rate reaches approximately 90%, we are successfully providing new value in insurance by capturing this segment.

Number of new policies by age group

- Annual statistics on customer age and gender (FY2024) compiled by The Life Insurance Association of Japan. Based on number of new policies.

- Lifenet Insurance new customer data (FY2024, N = 73,260) compiled by Lifenet customer survey.

- FY2024 valid responses of 857.

Since our launch, we have refined our online-focus business model to build the "No. 1 in Online Life Insurance" brand. As a results, we have become the partner of choice for companies across various industries with a high interest in online financial services.

Our unique business model, leveraging online capabilities, meets the needs of companies from other industries entering the insurance business. We are actively developing partnerships that utilize each other's strengths.

By providing new value created through "Life Insurance × Cross-Industry " to our partners' customer bases, we are realizing both the expansion of the online life insurance market and our own business growth.

For more details, please refer to our Mid-term Business Plan.