- JA

- EN

Intro to Lifenet Insurance

Introducing our strengths and uniqueness as a leading online life insurer

Why do we provide online life insurance?

What do we provide to achieve Outcome goal?

To whom do we provide insurance to achieve Outcome goal?

How will we grow to achieve Outcome goal?

Why do we provide online life insurance?

We aim to realize our Outcome goal: a society where next generations can be nutured with confidence in the future

Through online insurance, we aim to reduce future uncertainties for younger generations, empowering them to pursue their desired lifestyles and embrace challenges.

Initiatives for sustainability

What do we provide to achieve Outcome goal?

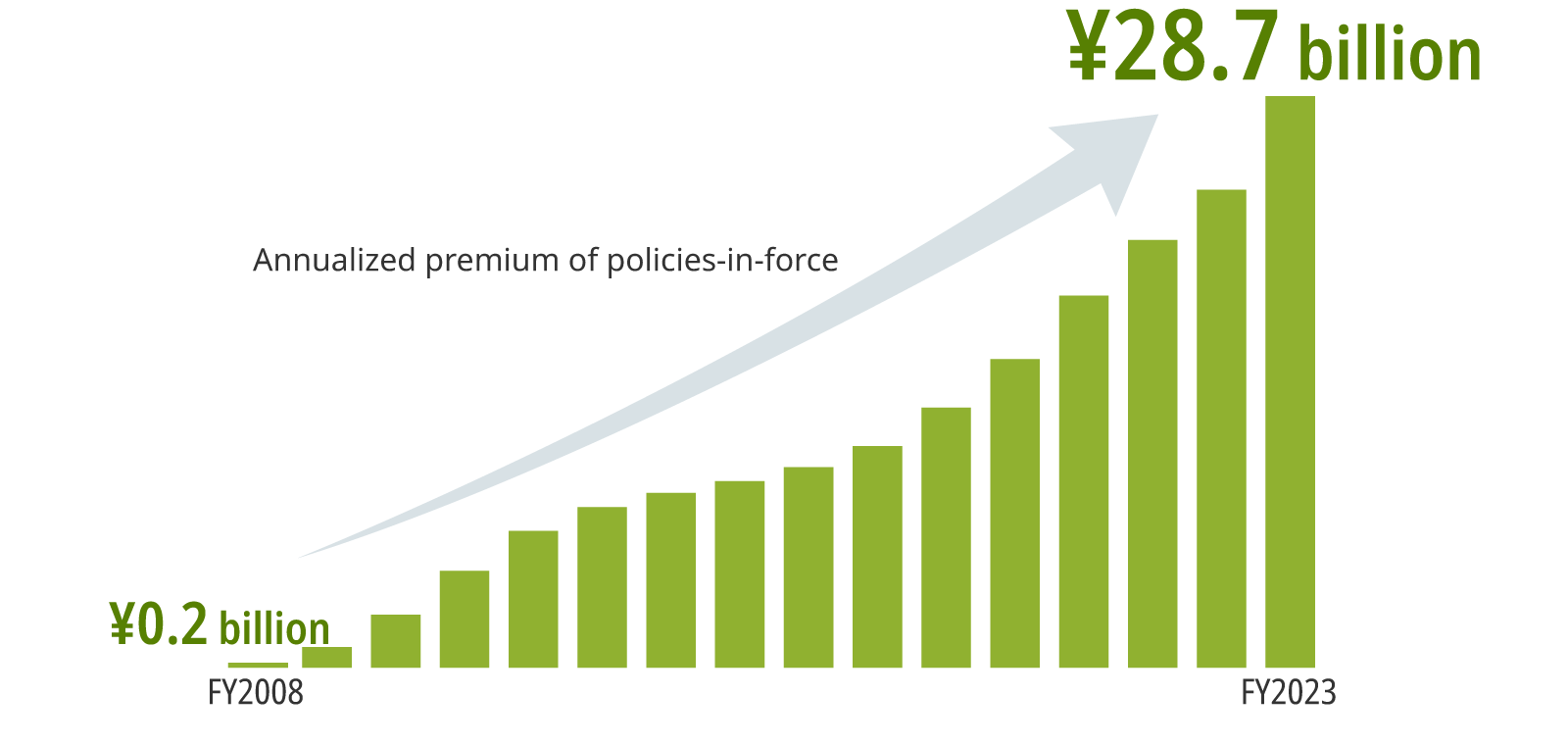

We use the benefits of technology to provide individual and group credit life insurance

Lifenet’s FeaturesSincere, Easy-to-understand, Affordable and Convenient

-

SincereOnly life insurer fully discloses all the pricing elements of insurance premiums

-

Easy-to-understandCustomer-oriented, simple and easy-to-understand products

-

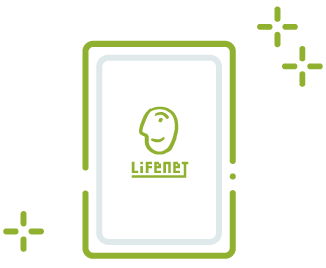

AffordablePassing on to customers the cost savings from online applications

-

ConvenientApplication available anytime anywhere

Individual life insurance business

Lifenet brand’s products and servicesDirect business

Products and services offered in the ecosystems of partner companiesPartner business

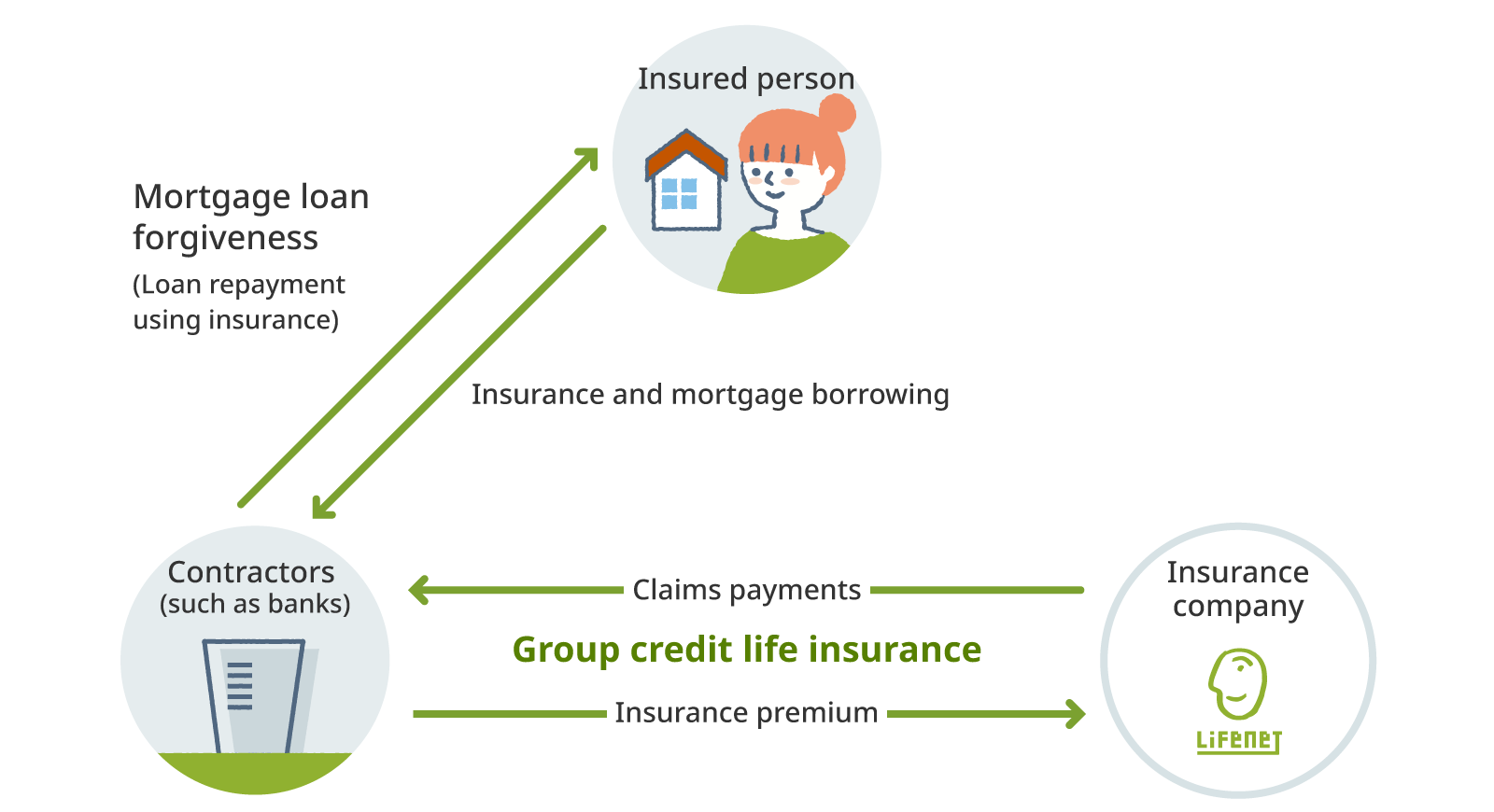

Group credit life insurance business

Insurance for the death or severe disability of

a mortgage loan borrower

Group insurance policy purchased through a financial institution

Our parnter bank (as of March, 2025)

Steady growth in two businesses

Third-party evaluations

The latest financial data

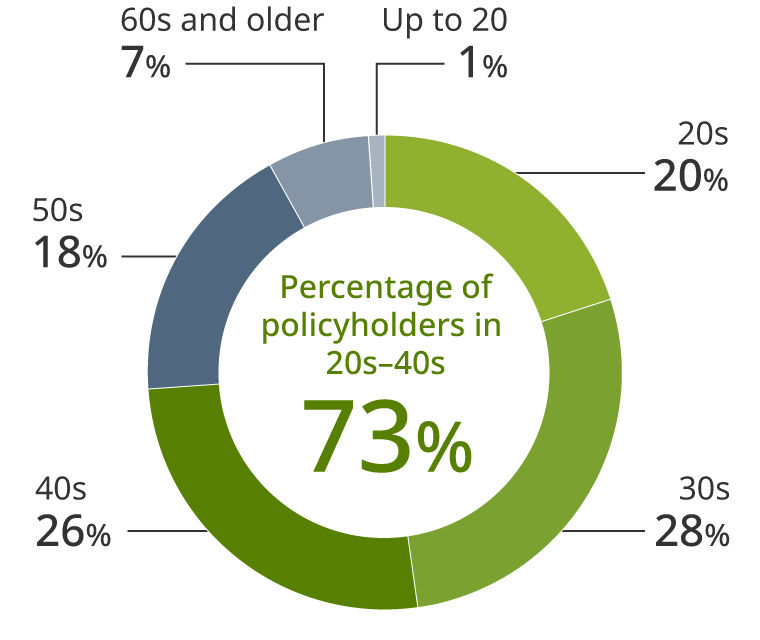

To whom do we provide insurance to achieve Outcome goal?

We focus on offering insurance to young,

first-time insurance buyers

AgeMainly 20s-40s*1

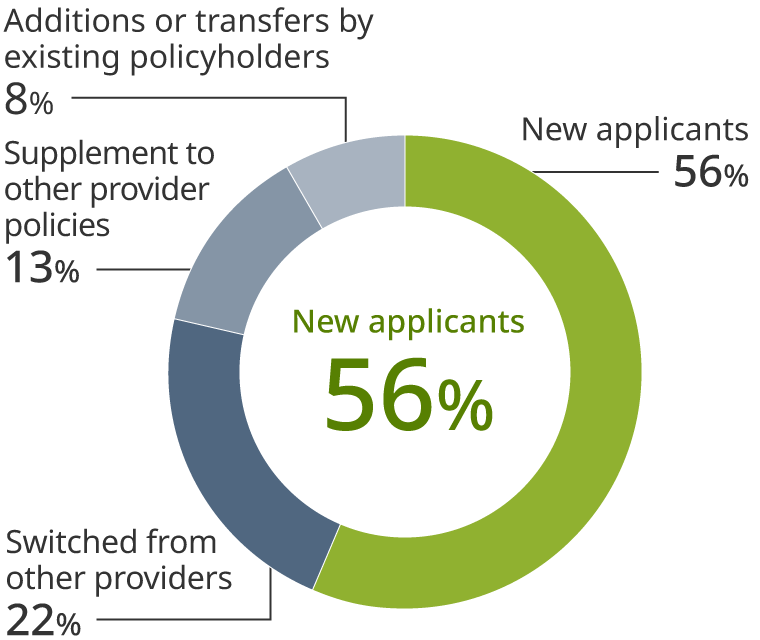

Roughly half of customersFirst-time policyholders*2

- *1 Based on the number of new policies in FY2024 (73,260) Source: Lifenet Insurance New Policy Data (FY2024)

- *2 FY2024 applicants; based on 857 valid responses

Our strengths, features, and business models

How will we grow to achieve Outcome goal?

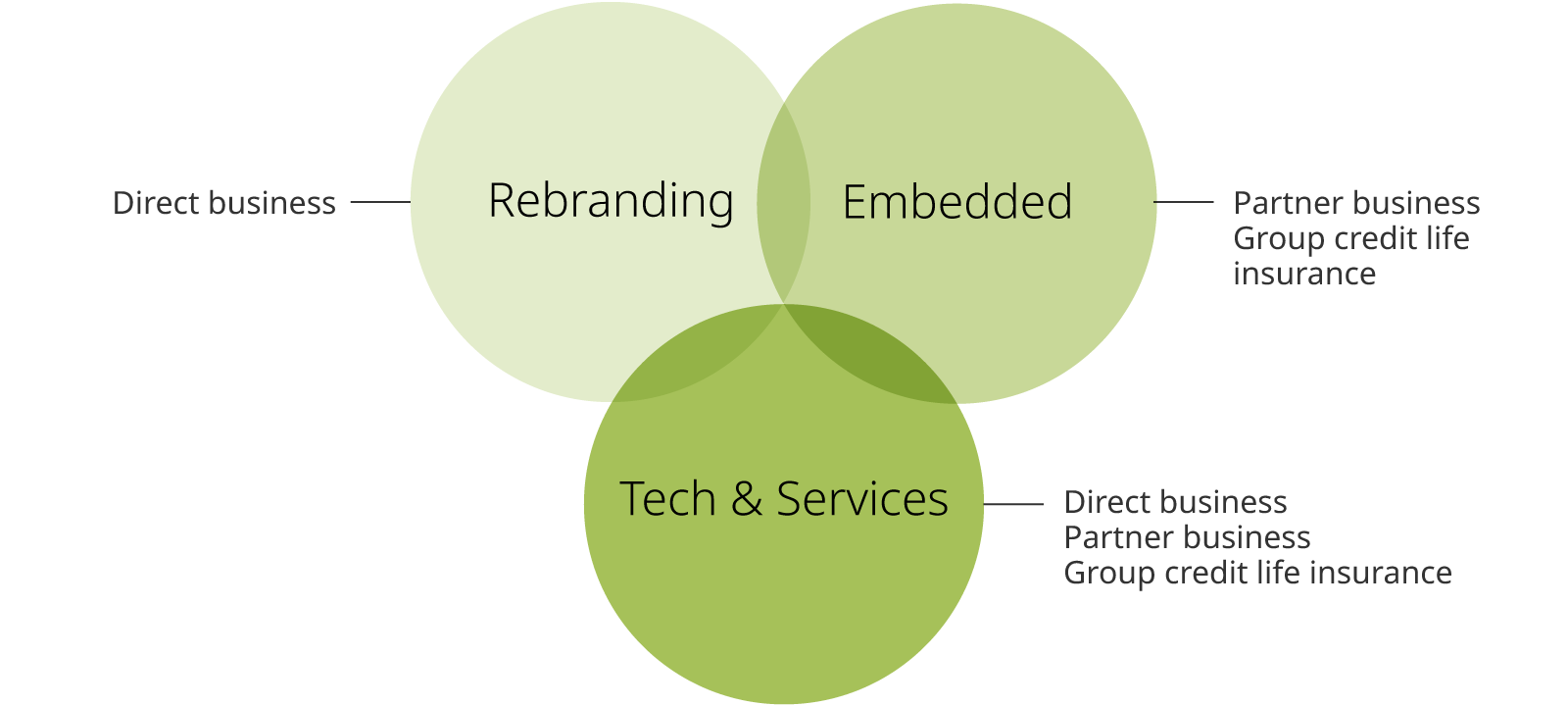

We strengthen three priority areas

to take Lifenet to the next stage

Rebranding

Strengthening our brand to align with the values of young customers

Embedded

Embedding our insurance business into partner ecosystems

Tech & Services

Improving convenience incorporating AI and Individual Number System technology

- Individual Number System is a system in which all people living in Japan are given an individual identification number for the purpose of improving convenience and others for citizens. It is also available online and you can apply to services online related to parenting by the one-stop service and can receive notifications from administrative organizations.

Details on our business strategies